Bitcoin is trending now in all over world for making money online and everyone is thinking how the value of Bitcoin increases or decreases. People are thinking how the value of regulates. After a big jump in value of Bitcoin we curious how it determine! And we will think to buy it when price gone down. Before any kind of investment we must need to understand “how much we will get in return in how much time?”. The factors involved which regulate it.

Total number of Bitcoins are 21 million in the world which means that requirement must follow this level of inflation to stay the price constant. One bitcoin includes 1,000,000 (one million) bits. 16.7 million bitcoins are already in market and bitcoin mining is continues to reach at 21 millions figure. The price of a bitcoin is calculated by supply and demand.

The price of Bit Coin rise with demand of bitcoins and when the price falls when demand falls because stock has limited boundary. Because Bitcoin is still a relatively small market compared to what it could be, it doesn’t acquire major amounts of money to move the market price up or down, and thus the price of a bitcoin is still very unstable. Nobody is “in charge” of Bitcoin – at least in the sense that Bitcoin is not a company or organization, has no governing body and no managerial structure.

Until Bitcoin becomes the favorite currency around the world, it will be gone more popular for traders. So the price is depend on market forces of supply and demand which, at this point in time, goes hand in hand with the trends, as a result, the price moves frequently up and down with news events. If more bits occupied the price rises, if it places extra hurdles towards mass acceptance, the price will fall. For trade on bitcoin you have to track latest Bitcoin price movements in real time with Bitcoin authorized website data charts.

Risk free Money Making Ideas From Bitcoin

Some unfortunate event such as large hack affects a key Bitcoin exchange, wallet or essential software which reasons the price to rinse. This happened when Mt. Gox meltdown in 2014 thefts at Bitstamp and Bitfinex, plus numerous other smaller companies.

A big market start to regulate Bitcoin in anyway can fluctuate price respectively (when the Chinese government limited Bitcoin exchanges’ practices in 2013, the price down). It may be an internal issue, such as a miners’ conference or meeting to decide changes to the Bitcoin protocol; the price sometimes dips if a block size or scaling agreement cannot be reached, or seems to be too far off.

Rumors of fake news or real news can affects the price may be only unclearly related to Bitcoin. Dramatic economic/financial rules like bank runs or bailouts, new tax policies, negative interest rates, stock market crashes, banking instability or government bankruptcies all propose a new kind of asset class may be preferable, and the Bitcoin price increases.

External Factors

Many countries government, users and private company decisions is the most important factors on which Bitcoin Fluctuate depend. If any Government bans bitcoin then the value will be gone down. Further if any big brand like amazon, Ebay will start accepting bitcoin in payment mode then the rate will be increased. If we will check the history we notice that big online brand Bit Coin acceptance as payment has given higher jump in valuation.

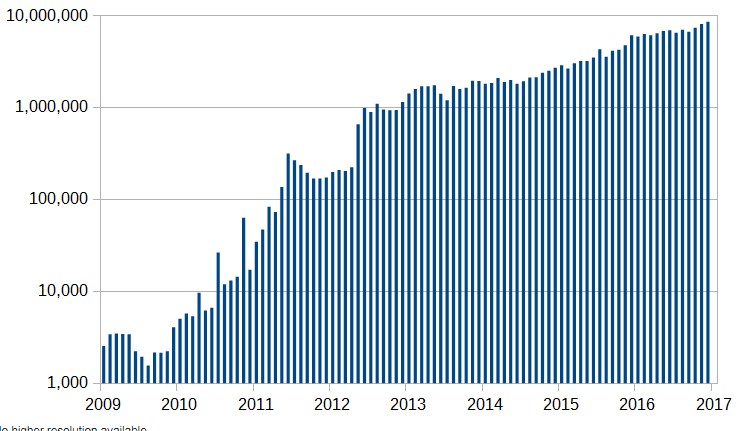

Number of Transaction

We know that Bitcoin is not regulated from any central bank or Authority. Its digital payments which can be exchanged between users with very less transaction fees. If we check the truncation chart of bitcoin then we found that valuation increased with the numbers of online Bitcoin transaction. Please check the below chart for more details.

In all of this, if you want trade with Bitcoin then be careful as it can also be mysterious and unpredictable.